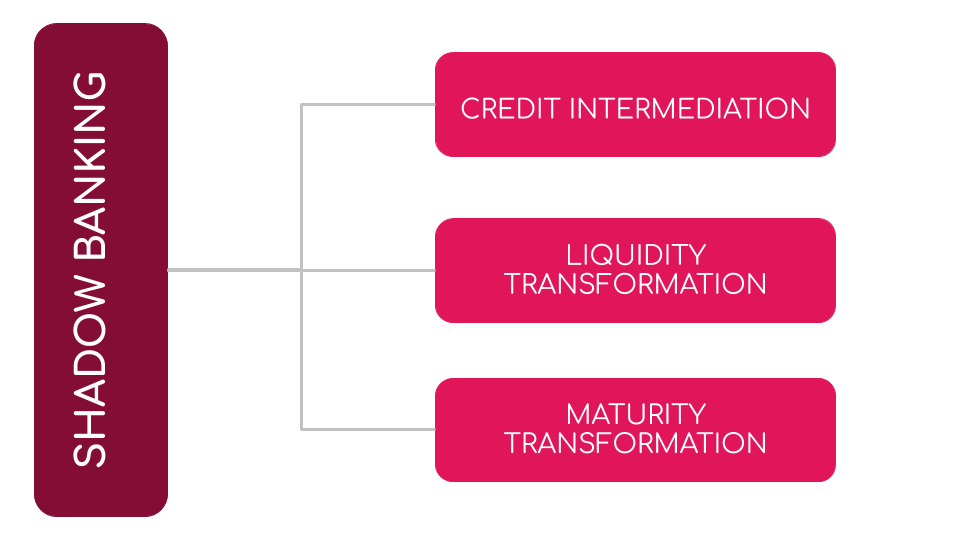

A universally accepted official definition for shadow banking has not yet been introduced by any of the formal institutes and therefore, most of the people tend to define shadow banking as the “credit intermediation between entities which takes place outside the regular banking system”. But referring the shadow banking only to the credit intermediation is a bit misleading since it involves in other areas such as liquidity transformation and maturity transformation in addition to the credit intermediation. Therefore, shadow banking can simply be defined as the banking activities which takes place outside the regular banking system. The following diagram shows the areas which are covered by the shadow banking system.

Credit intermediation refers to the process of raising funds from the surplus parties and facilitating the deficit parties with the funds obtained from the surplus parties while keeping a higher margin by the intermediate company. Here the intermediate role is played by the shadow banks.

Liquidity transformation refers to the process of using liquid assets to fiancé less liquid assets while the maturity transformation is the activity which involves using short term funding for long term assets.

As the shadow banking activities take place outside the regular banking system, this is subjected to fewer regulations. In other words, there is a difference between the regular banking system and the shadow banking system; in terms of the regulations to which they are exposed. The reason behind having such a difference is all because of the banks are subjected to a social contract where each depositor is secured up to Rs. 600000. This is a safety mechanism provided to depositors of regular banking systems and not applicable to the depositors of the shadow banking systems. Therefore the authorities have imposed stringent regulations on the banking institutions which are coming under the direct supervision of the central bank of Sri Lanka. Since such a safety mechanism has not been provided to the depositors of the shadow banking system they are not required to comply with so much of regulations as a regular banking system does.

Having said that, since the shadow banking system is subjected to fewer regulations the extent to which they can cater the needs of the deficit and the surplus parties are greater compared to the regular or the traditional banking system. Therefore it poses a huge risk on the banking system of the country and ultimately it poses risks on the financial system stability as well. List of such ways of posing risks on the banking system and on the financial system stability is listed below in detail.

Generating adverse consequences on the banking sector

As it was mentioned previously, one of the major activities involved in shadow banking is the liquidity transformation. In that particular transformation, a shadow banking system highly relies on the short term findings obtained by the depositors. Here what they are really doing is, they are utilizing the liquid assets to finance the less liquid assets. Meanwhile, you will be wondering as to how banks can do such wanders since banks are subjected to high regulations. But here we are talking about shadow banking systems which are subjected to fewer regulations. So that they keep relying more on the short term funding sources, unlike the regular banking systems. As a consequence it creates problems in their funding profiles which again creates spillover effects on the banking sector. This, in turn, creates adverse effects on financial system stability.

Creation of a leverage and maturity mismatch

One of the major activities that the shadow banking undertakes is the maturity and liquidity transformation. There they facilitate the long term borrowers from the funds they obtained by the short term depositors. For that, they highly rely on the short term borrowings. Since they are subjected to fewer regulations, they are not really required to worry about their funding profile as well. The higher the short term funding sources the greater they can make profits by giving them out as loans to the deficit parties. So automatically a maturity mismatch is created as a consequence. Further to increase their profitability, what do they do is they highly leverage their activities. When the maturity mismatch is coupled with higher leverage it causes unfavourable impacts on the banking system and ultimately on the financial stability.

Loss of customer confidence

The shadow banking system being subjected to fewer regulations; they are in a position to cater to the needs of the customers in high capacities than the regular banking system. Due to reasons such as being less regulated and having problems in the funding profiles the possibility of the shadow banking systems can go wrong is greater. But in the case of the regular banking system, the possibility of going wrong is comparatively low since they are subjected to greater regulations and frequent supervision by the respective monetary authorities. So if a small mistake happens in the shadow banking system can cause a loss of customer confidence in relation to the entire banking system regardless of the regular and the shadow banking system.

Possibility of a bank run

A bank run can simply be defined as a situation where a great number of depositors start to withdraw their money with short notice. Basically, this type of situation is expected to be seen where the customers lose their confidence in the banking system. So when the shadow banks keep representing the functions such as credit intermediation, liquidity and maturity transformation exceeding the norms in the banking industry, even a small mistake by a shadow bank can cause the customers for them to lose their confidence in the banking sector. This ultimately drives the customers of the banks towards a bank run.

Systemic risk

Systemic risk is the situation where a collapse in one bank not being subjected to that particular bank but being spread to the other banks in the industry regardless of the shadow banks and the regular banks. As a consequence of the adverse effects of the shadow banks, it creates a loss of confidence in the banking customers which then creates a bank run and which pave the path to a systemic risk which finally poses a greater risk on the financial system stability.

Summary

Shadow banking is the banking activities which takes place outside the regular banking system. This has some adverse impacts on the banking system and the financial system stability due to reasons such as generating adverse consequences on the banking sector, Creation of a leverage and maturity mismatch, Loss of customer confidence, Possibility of a bank run and Systemic risk etc. Since only the adverse side of the shadow banking was addressed by this article it should be noted even at the end of the article that the shadow banking is not really bad for the economy as it offers some benefits to the economy.